The new tax reform bill has been signed by President Duterte today. The TRAIN, as it is commonly referred to, has adjusted taxes on several categories including a tax exemption on all personal income tax below Php250,000USD 4,245INR 361,325EUR 4,088CNY 31,000 (annually).

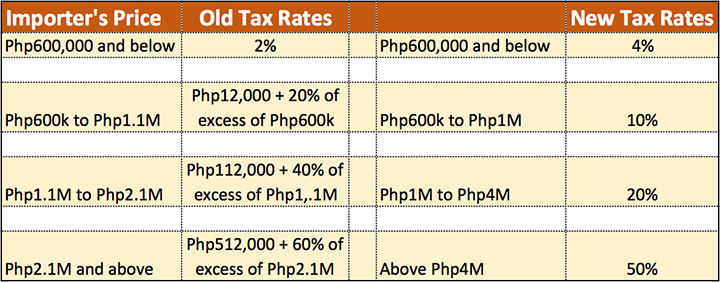

Likewise, automobiles will have a new or simpler tax structure. For cars, the new tax scheme is as follows:

Net Manufacturer’s / Importer’s Price

Up to P600,000 == 4%

P600,000 to 1,000,000 == 10%

P1,000,000 to 4,000,000 == 20%

Above P4,000,000 == 50%

Take note that these are based on Net Manufacturer’s Price or Importers Price.

Here’s a comparison table between the old and the new tax scheme.

Let’s do some examples.

Importer’s Price: Php600,000USD 10,188INR 867,180EUR 9,810CNY 74,400

Base Price (Old Tax): Php612,000USD 10,392INR 884,524EUR 10,006CNY 75,888

Base Price (New Tax): Php624,000USD 10,596INR 901,867EUR 10,202CNY 77,376

Importer’s Price: Php800,000USD 13,584INR 1,156,240EUR 13,080CNY 99,200

Base Price (Old Tax): Php852,000USD 14,467INR 1,231,396EUR 13,930CNY 105,648

Base Price (New Tax): Php880,000USD 14,942INR 1,271,864EUR 14,388CNY 109,120

Importer’s Price: Php1USD 0.02INR 1EUR 0.02CNY 0.12,00,000

Base Price (Old Tax): Php1,092,000USD 18,542INR 1,578,268EUR 17,854CNY 135,408

Base Price (New Tax): Php1,100,000USD 18,678INR 1,589,830EUR 17,985CNY 136,400

Importer’s Price: Php1,500,000USD 25,470INR 2,167,950EUR 24,525CNY 186,000

Base Price (Old Tax): Php1,772,000USD 30,089INR 2,561,072EUR 28,972CNY 219,728

Base Price (New Tax): Php1,800,000USD 30,564INR 2,601,540EUR 29,430CNY 223,200

Importer’s Price: Php2,500,000USD 42,450INR 3,613,250EUR 40,875CNY 310,000

Base Price (Old Tax): Php3,252,000USD 55,219INR 4,700,116EUR 53,170CNY 403,248

Base Price (New Tax): Php3,000,000USD 50,940INR 4,335,900EUR 49,050CNY 372,000

Importer’s Price: Php3,000,000USD 50,940INR 4,335,900EUR 49,050CNY 372,000

Base Price (Old Tax): Php4,052,000USD 68,803INR 5,856,356EUR 66,250CNY 502,448

Base Price (New Tax): Php3,600,000USD 61,128INR 5,203,080EUR 58,860CNY 446,400

Importer’s Price: Php4,000,000USD 67,920INR 5,781,200EUR 65,400CNY 496,000

Base Price (Old Tax): Php5,652,000USD 95,971INR 8,168,836EUR 92,410CNY 700,848

Base Price (New Tax): Php4,800,000USD 81,504INR 6,937,440EUR 78,480CNY 595,200

Importer’s Price: Php5,000,000USD 84,900INR 7,226,500EUR 81,750CNY 620,000

Base Price (Old Tax): Php7,252,000USD 123,139INR 10,481,316EUR 118,570CNY 899,248

Base Price (New Tax): Php6,000,000USD 101,880INR 8,671,800EUR 98,100CNY 744,000

With the Base Price, the dealers will still have to add their gross profit margins as well before we end up with the final selling price.

Just looking at the taxes the author computed and if i am to plot this on a graph, the old tax scheme will have a line with + slope, i.e., as the base price increases, tax increases.

For the new scheme, it is also has a + slope but as the base price increases, the tax increases at a lower rate than the old scheme.

Comparing the 2 scheme, old scheme will make you pay higher taxes at each increase in base price. The new scheme is subtle in tax increase as base price increases.

The new scheme aims to raise taxes on new vehicles with base price of 2M and below. Halos lahat ng bagong sasakyan nasa price range na yan.

I think the base price in your example already includes the margin for the dealer. You mentioned manufacturer’s or importers “price”, not “cost”.

Base dun sa radio interview sa DZMM, iba pa yung dealer’s price then the SRP.

Gago talaga ang mga politician sa pinas. Gusto lang nila na bumaba ang price ng mga luxury vehicles na binibili nila. Oh karma where are you na?