The new tax reform bill has been signed by President Duterte today. The TRAIN, as it is commonly referred to, has adjusted taxes on several categories including a tax exemption on all personal income tax below Php250,000 (annually).

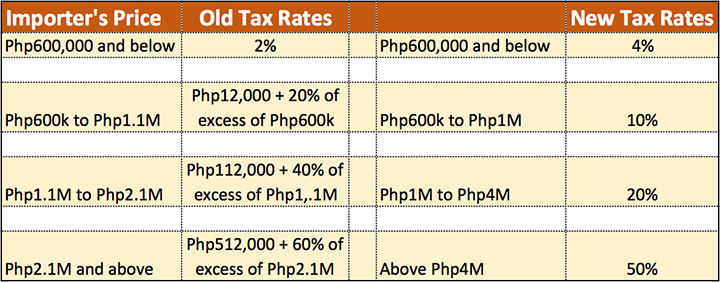

Likewise, automobiles will have a new or simpler tax structure. For cars, the new tax scheme is as follows:

Net Manufacturer’s / Importer’s Price

Up to P600,000 == 4%

P600,000 to 1,000,000 == 10%

P1,000,000 to 4,000,000 == 20%

Above P4,000,000 == 50%

Take note that these are based on Net Manufacturer’s Price or Importers Price.

Here’s a comparison table between the old and the new tax scheme.

Let’s do some examples.

Importer’s Price: Php600,000

Base Price (Old Tax): Php612,000

Base Price (New Tax): Php624,000

Importer’s Price: Php800,000

Base Price (Old Tax): Php852,000

Base Price (New Tax): Php880,000

Importer’s Price: Php1,00,000

Base Price (Old Tax): Php1,092,000

Base Price (New Tax): Php1,100,000

Importer’s Price: Php1,500,000

Base Price (Old Tax): Php1,772,000

Base Price (New Tax): Php1,800,000

Importer’s Price: Php2,500,000

Base Price (Old Tax): Php3,252,000

Base Price (New Tax): Php3,000,000

Importer’s Price: Php3,000,000

Base Price (Old Tax): Php4,052,000

Base Price (New Tax): Php3,600,000

Importer’s Price: Php4,000,000

Base Price (Old Tax): Php5,652,000

Base Price (New Tax): Php4,800,000

Importer’s Price: Php5,000,000

Base Price (Old Tax): Php7,252,000

Base Price (New Tax): Php6,000,000

With the Base Price, the dealers will still have to add their gross profit margins as well before we end up with the final selling price.

Just looking at the taxes the author computed and if i am to plot this on a graph, the old tax scheme will have a line with + slope, i.e., as the base price increases, tax increases.

For the new scheme, it is also has a + slope but as the base price increases, the tax increases at a lower rate than the old scheme.

Comparing the 2 scheme, old scheme will make you pay higher taxes at each increase in base price. The new scheme is subtle in tax increase as base price increases.

The new scheme aims to raise taxes on new vehicles with base price of 2M and below. Halos lahat ng bagong sasakyan nasa price range na yan.

I think the base price in your example already includes the margin for the dealer. You mentioned manufacturer’s or importers “price”, not “cost”.

Base dun sa radio interview sa DZMM, iba pa yung dealer’s price then the SRP.

Gago talaga ang mga politician sa pinas. Gusto lang nila na bumaba ang price ng mga luxury vehicles na binibili nila. Oh karma where are you na?