Under Republic Act 8794, the Motor Vehicle User’s Charge or MVUC was “enacted primarily to provide additional revenue to the national government for the maintenance of national and provincial roads”. This charge is applied to the registration cost of motor vehicles and will depend on their gross vehicle weight (GVW). Recently, a proposal was pushed by Congress to increase its rate.

Congressman proposes increase in MVUC rather than on junk food and sweetened drinks

According to reports, the House of Representatives tax panel yesterday said that it will consider a proposal to increase the Motor Vehicle User’s Charge before a previous proposal to increase the excise tax on junk food and sweetened beverages. The Chair of the House Committee on Ways and Means, Albay Rep. Jose Ma. Salceda, said “We will discuss taxes that hit the rich first. That’s our constitutional duty.”

He later added that he still has some questions regarding the proposed tax hike on food and beverage items that is being pushed by both the Department of Finance and the Department of Health and that he would like to consider other options.

Photo: LTO

Taking into account the cost of road maintenance and repair, it is estimated that the National Government spends around the area of PHP 300USD 5INR 434EUR 5CNY 37 billion every year. Around PHP 18USD 0.31INR 26EUR 0.29CNY 2 billion is covered by the collected MVUC fees in a year, and this prompted the congressman to deduce that car owners are heavily subsidized for car use.

Another part of the proposal is to exempt motorcycles and tricycles from the fee increase. “My proposal is to exempt motorcycles from MVUC. Especially since it’s a means of living now, with delivery express services and the like. Tricycles will also be exempt under my proposal,” Salceda said. Salceda likewise reiterated that the tax panel will discuss the motor vehicle tax and the proposed luxury goods tax, which President Marcos already gave his support for before they discuss proposals for junk food taxes.

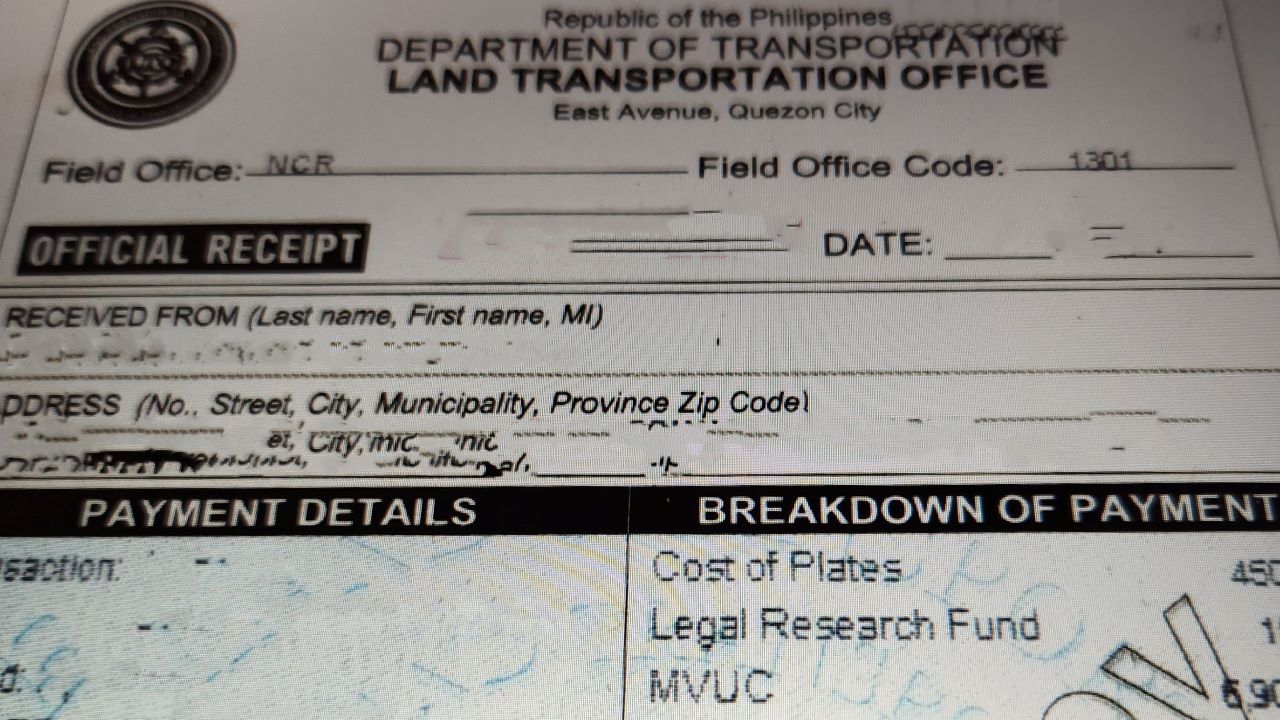

If one would look at his or her vehicle’s registration papers, an item for the MVUC can be seen. If you’re wondering what cost is currently mandated by the LTO and the law, you can find that here.

What do you think will the overall effect of this proposal be, should it be implemented? Will it ease traffic? Will it “discourage” ownership and use of motor vehicles? Will the collected fees, indeed, be put to use where they are meant to be? Is it a band-aid solution and will it be a source of temptation and corruption? We reckon your insights and comments will be most interesting, to say the least.

It’s difficult to find knowledgeable people for this subject, but you sound like you know what you’re talking about! Thanks